Property Tax Rates Oregon . find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. Find out about property tax exemptions, limitations,. the highest property tax rate, in oregon is 1.06% in harney county. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. learn how property taxes are assessed, calculated, and collected in oregon. Learn how oregon limits property tax rates and assessed values with. See interactive table, map, and pdf download of property tax. The lowest property tax rate, is 0.55% in curry county and. compare median property tax, home value, and income in oregon's 36 counties. calculate your property taxes in oregon based on home value, mortgage type and county.

from itep.org

compare median property tax, home value, and income in oregon's 36 counties. learn how property taxes are assessed, calculated, and collected in oregon. the highest property tax rate, in oregon is 1.06% in harney county. Learn how oregon limits property tax rates and assessed values with. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. See interactive table, map, and pdf download of property tax. The lowest property tax rate, is 0.55% in curry county and. Find out about property tax exemptions, limitations,. find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. calculate your property taxes in oregon based on home value, mortgage type and county.

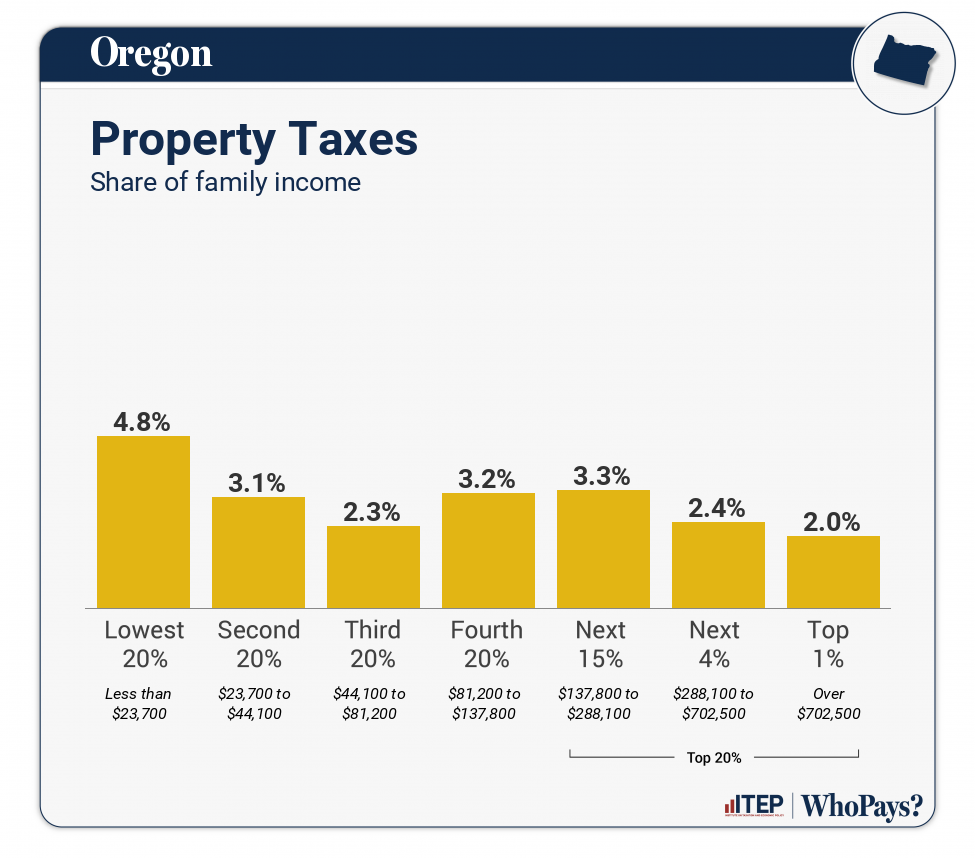

Oregon Who Pays? 7th Edition ITEP

Property Tax Rates Oregon Find out about property tax exemptions, limitations,. the highest property tax rate, in oregon is 1.06% in harney county. The lowest property tax rate, is 0.55% in curry county and. find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. Find out about property tax exemptions, limitations,. Learn how oregon limits property tax rates and assessed values with. learn how property taxes are assessed, calculated, and collected in oregon. compare median property tax, home value, and income in oregon's 36 counties. calculate your property taxes in oregon based on home value, mortgage type and county. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. See interactive table, map, and pdf download of property tax.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rates Oregon find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. Find out about property tax exemptions, limitations,. learn how property taxes are assessed, calculated, and collected in oregon. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon,. Property Tax Rates Oregon.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rates Oregon The lowest property tax rate, is 0.55% in curry county and. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. the highest property tax rate, in oregon is 1.06% in harney county. learn how property taxes are assessed, calculated, and collected in oregon. See. Property Tax Rates Oregon.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Property Tax Rates Oregon Learn how oregon limits property tax rates and assessed values with. Find out about property tax exemptions, limitations,. the highest property tax rate, in oregon is 1.06% in harney county. compare median property tax, home value, and income in oregon's 36 counties. the web page lists the effective tax rates per $1,000 of real market value for. Property Tax Rates Oregon.

From taxfoundation.org

2020 State Individual Tax Rates and Brackets Tax Foundation Property Tax Rates Oregon learn how property taxes are assessed, calculated, and collected in oregon. Learn how oregon limits property tax rates and assessed values with. compare median property tax, home value, and income in oregon's 36 counties. find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. calculate your. Property Tax Rates Oregon.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rates Oregon find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. calculate your property taxes in oregon based on home value, mortgage type and county. compare median property tax, home value, and income in oregon's 36 counties. See interactive table, map, and pdf download of property tax. . Property Tax Rates Oregon.

From oregoncatalyst.com

Portland area property tax bills would increase over 13 The Oregon Catalyst Property Tax Rates Oregon learn how property taxes are assessed, calculated, and collected in oregon. compare median property tax, home value, and income in oregon's 36 counties. calculate your property taxes in oregon based on home value, mortgage type and county. Find out about property tax exemptions, limitations,. the highest property tax rate, in oregon is 1.06% in harney county.. Property Tax Rates Oregon.

From www.oregonlive.com

How do your property taxes compare to your neighbors'? Multnomah County auditor's map lets you Property Tax Rates Oregon learn how property taxes are assessed, calculated, and collected in oregon. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. The lowest property tax rate, is 0.55% in curry county and. Learn how oregon limits property tax rates and assessed values with. find annual. Property Tax Rates Oregon.

From cewdgcbq.blob.core.windows.net

Oregon Property Tax Rate at Louise Hazzard blog Property Tax Rates Oregon calculate your property taxes in oregon based on home value, mortgage type and county. learn how property taxes are assessed, calculated, and collected in oregon. compare median property tax, home value, and income in oregon's 36 counties. Find out about property tax exemptions, limitations,. the web page lists the effective tax rates per $1,000 of real. Property Tax Rates Oregon.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rates Oregon Find out about property tax exemptions, limitations,. find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. See interactive table, map, and pdf download of property tax. learn how property taxes are assessed, calculated, and collected in oregon. calculate your property taxes in oregon based on home. Property Tax Rates Oregon.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rates Oregon the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. the highest property tax rate, in oregon is 1.06% in harney county. calculate your property taxes in oregon based on home value, mortgage type and county. Learn how oregon limits property tax rates and assessed. Property Tax Rates Oregon.

From itep.org

Oregon Who Pays? 7th Edition ITEP Property Tax Rates Oregon Find out about property tax exemptions, limitations,. the highest property tax rate, in oregon is 1.06% in harney county. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. learn how property taxes are assessed, calculated, and collected in oregon. calculate your property taxes. Property Tax Rates Oregon.

From wallethub.com

Property Taxes by State Property Tax Rates Oregon compare median property tax, home value, and income in oregon's 36 counties. the highest property tax rate, in oregon is 1.06% in harney county. See interactive table, map, and pdf download of property tax. find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. calculate your. Property Tax Rates Oregon.

From forocoches.com

Seguro médico en California. 31.368 dólares al año. 2614 dólares al mes. Página 7 Forocoches Property Tax Rates Oregon Learn how oregon limits property tax rates and assessed values with. compare median property tax, home value, and income in oregon's 36 counties. learn how property taxes are assessed, calculated, and collected in oregon. Find out about property tax exemptions, limitations,. The lowest property tax rate, is 0.55% in curry county and. the web page lists the. Property Tax Rates Oregon.

From taxfoundation.org

2023 State Estate Taxes and State Inheritance Taxes Property Tax Rates Oregon compare median property tax, home value, and income in oregon's 36 counties. Learn how oregon limits property tax rates and assessed values with. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. Find out about property tax exemptions, limitations,. the highest property tax rate,. Property Tax Rates Oregon.

From taxfoundation.org

Weekly Map State and Local Sales Tax Rates, 2013 Property Tax Rates Oregon Find out about property tax exemptions, limitations,. find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. Learn how oregon limits property tax rates and assessed values with. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based. Property Tax Rates Oregon.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rates Oregon learn how property taxes are assessed, calculated, and collected in oregon. find annual reports and supplements on property tax system, assessed value, market value and levies by county and district type. calculate your property taxes in oregon based on home value, mortgage type and county. The lowest property tax rate, is 0.55% in curry county and. . Property Tax Rates Oregon.

From theopt.com

Explaining Oregon Property Taxes Opt Real Estate Property Tax Rates Oregon learn how property taxes are assessed, calculated, and collected in oregon. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based on the. Find out about property tax exemptions, limitations,. Learn how oregon limits property tax rates and assessed values with. find annual reports and supplements on. Property Tax Rates Oregon.

From www.thebalance.com

A List of Tax Rates for Each State Property Tax Rates Oregon The lowest property tax rate, is 0.55% in curry county and. Find out about property tax exemptions, limitations,. See interactive table, map, and pdf download of property tax. Learn how oregon limits property tax rates and assessed values with. the web page lists the effective tax rates per $1,000 of real market value for each county in oregon, based. Property Tax Rates Oregon.